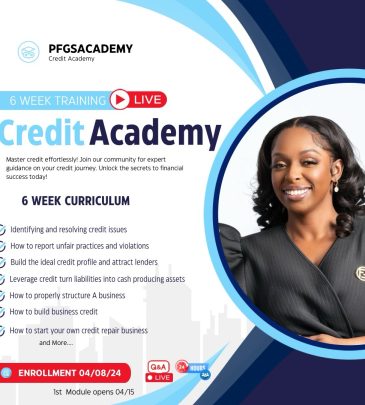

Course Description

The goal of financial stability is something we all strive for. A strong credit score is a key factor in achieving financial freedom. Everyone deals with credit, it governs every aspect of our lives. However, many people are faced with the uncertainty of spiraling into debt due to unforeseen circumstances, such as loss of employment, a serious illness, or losing a spouse. causing you to have a harder time finding a job, renting an apartment, or purchasing a house, or paying for insurance, more interest, and fees. Thankfully, debt can be eliminated, and credit can be managed.

In this course, you will learn how to apply for a credit to your everyday life. Manage, rebuild bad credit and maintain good credit as well. Individuals will be able to eliminate debt, improve credit scores, fix your credit, and learn how to manage your financial situation so bad credit will become a thing of the past.

Using our program, you’ll learn how to do everything on your own, so that you won’t need to hire a credit repair company or seek financial counseling services. You’ll have access to everything you need to take charge of your finances.

Exclusive Offer

When you join the Financially Fit online financial literacy membership program: You receive access to 4 additional courses ABSOULTELY FREE – Gain complimentary access to the following courses:

- Financially Fit

- Budgeting Like A Boss

- Home Buyer Certification

- Real Estate Investing

- Buy the car, Don’t get took for a ride

Certification

- Document Your Lifelong Learning Achievements.

- Earn an Official Certificate Documenting Course Hours and Credit training.

- View and Share Your Certificate Online or Download/Print as PDF.

- Display Your Certificate on Your Resume and Promote Your Achievements Using Social Media

What You Will Learn Learning Outcomes

- Easy, proven steps to a more secure Future in Personal Finance, credit education, Debt Management, Investing, and Financial Freedom

- How to improve your overall financial situation

- A plan of action to successfully get out of debt

- Understanding your credit score

- How to fix your credit

- How to instantly build positive credit

- Information packed practical training on personal finance and wealth-building

- Preparing for homeownership, and how to make sure you qualify

- How to buy a home and save

- How to successfully budget and still splurge

- Buy a car without feeling like you have been taken for a ride

- How to begin investing in real estate, even with little to no money

- and much more

Course Features

- Lectures 108

- Quiz 0

- Duration Lifetime access

- Skill level All levels

- Language English

- Students 15526

- Certificate Yes

- Assessments Yes

Requirements

- Internet connection, smart device

Features

- Financial Literacy

- Preparing and balancing a budget

- Sorting the necessities and managing expenses

- How to budget your money and still splurge a bit

- The Fundamentals of Credit

- Fix Your Own Credit - DIY Credit Repair

- Preparing For Homeownership

- Real Estate Investing

- and much much more...

Target audiences

- Individuals with bad credit

- Individuals who need to manage credit and eliminate debt

- individuals who want build a better relationship with money

- Individuals who want to save more money and incorporate a budgeting system that actually works!

- Individuals who want to purchase a home or car without paying extremely high interest rates

- People who are ready to build the life they deserve

- Individuals wanting to build generational wealth

- individuals who want to have an unlimited income potential

- Individuals looking to invest in real estate and use other people's money to get started

- People who are ready to escape the hamster wheel.

- First time home buyers with credit issues